OPPD generation portfolio continues to evolve

Six years makes a big difference when comparing Omaha Public Power District’s generation make up. And OPPD plans to continue transforming how it generates electricity to a population nearing the one million mark.

changing mix

The OPPD fuel mix* in 2010 looked like this: 65 percent coal, 30 percent nuclear, 4 percent renewable (landfill gas and wind), 1 percent oil and natural gas.

Today’s mix shows more renewable energy. At the end of 2015, the mix included:

- About 63 percent coal

- 13 percent renewables

- 23 percent nuclear

- 1 percent oil and natural gas.

Nuclear is no longer a part of the mix. The nearly 500-megawatt Fort Calhoun Station (FCS) ceased operations in October and has started the decommissioning process. The plant was no longer economically feasible to operate.

more renewables

Since OPPD’s last IRP, in addition to the FCS decision, a regular review and planning resulted in the following decisions:

- In 2014, OPPD added nearly 200 megawatts of wind (Prairie Breeze) and announced plans for an additional 400 megawatts of wind (Grande Prairie) to come online in 2017).

- In 2014, OPPD announced plans to retire North Omaha Station Units 1-3 (its three oldest coal-generation units) and refueled them to natural gas in 2016. The utility also announced the addition of emission controls on North Omaha Station Units 4-5 and Nebraska City Station Unit 1.

These changes were in response to both current and proposed environmental regulations, as well as economics. The momentum has been further fueled by the strategic directives adopted by the OPPD board in late 2015.

Among these directives were policies that touched on resource planning, competitive rates, environmental stewardship and the mission to provide affordable, reliable and environmentally sensitive energy services to customers.

In these directives, the board established a rate target of 20 percent below the regional average. Recent resource planning efforts will allow OPPD to meet that target by 2020, as well as commit to no general rate increase through 2021.

a continual effort

OPPD plans to continually revisit generation options as technologies mature and they learn more about federal regulations limiting carbon emissions.

“Ongoing generation review is critical as the utility industry experiences dynamic changes at an accelerated pace,” said Brad Underwood, director of Corporate Planning & Analysis.

In early 2017, OPPD submitted an Integrated Resource Plan (IRP) to one of their energy partners, the Western Area Power Administration (WAPA), as part of a contractual commitment for hydroelectric power.

An IRP is a road map detailing how OPPD will generate power in the future. IRPs evolve over time to reflect the changing environment

“We utilize a comprehensive, forward-looking decision support tool for evaluating resource options to meet our objectives at the lowest cost,” said Underwood, who presented the plan to the OPPD Board of Directors in November, 2016. “The IRP process considers supply-and-demand resource options, fuel costs, as well as the technology costs and overall risk considerations associated with various resource plan outcomes.”

Underwood outlined four portfolios in the IRP for the board, senior management and the public, including those viewing the meeting online via live stream. The next step, he told them, was conducting stakeholder outreach over the next month.

Based on the portfolios, the future continues to include additional renewable energy that the board and senior management set their sights on more than seven years ago.

Renewables vision began in earnest in 2009

The change story started in 2009.

At that time, OPPD’s board voluntarily set a goal of adding renewable energy. They gave the utility until 2020 to reach the goal of having renewable energy make up 10 percent of all electricity sold to retail customers. That goal was met six years ahead of schedule. Now, OPPD expects renewables to be at 30 percent of its retail sales in 2018, far exceeding that target.

As opportunities to add more renewables at affordable prices presented themselves, OPPD seized them. When the Grande Prairie wind facility is fully operational in 2017, OPPD will have 800 megawatts of wind power.

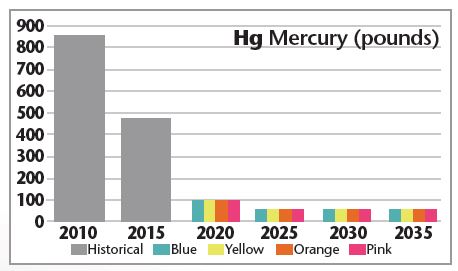

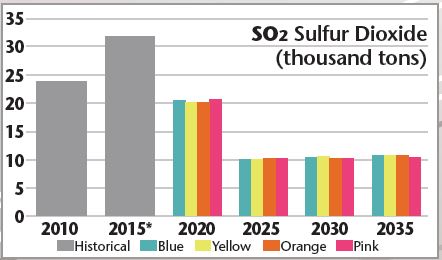

Furthering OPPD’s mission, the utility has significantly reduced emissions due to these changes, and these will continue to decrease.

These charts show emission reductions are comparable across the four portfolios: Portfolio Blue (the “rebalanced portfolio” identified during the Fort Calhoun Station analysis, most economical, includes 426 MW wind); Portfolio Yellow (includes 10 MW battery storage, 426 MW wind, $17 million more than Blue Portfolio); Portfolio Orange (includes 100 MW solar, 326 MW wind, $199 million more than Blue Portfolio); Portfolio Pink (includes 160 MW wind, $280 million more than Blue Portfolio).

*Fuel source as a percent of total generation (rounded, based on full-year data)

Paula Lukowski has more than 34 years of corporate communications experience. By far, her favorite aspect of that role has been profiling the great work done by OPPD employees and retirees. A master gardener, Paula and her husband Mark have two grown children and two grandsons.

View all posts by Paula Lukowski >